Key Metrics:

0.59x book value

5.37x earnings

4.87x EV/EBIT

20% discount to NCAV

Some of the best investments don’t come wrapped in complexity.

They’re easy to understand, with clean numbers and a straightforward balance sheet.

Today’s company is exactly that.

A simple, growing business trading for less than it should.

Not because something is fundamentally broken.

But because no one’s looking.

Coffee Holding Co. (JVA)

Coffee Holding Co. (JVA) is a quiet, family-run business from Staten Island, New York, founded in 1971.

It’s one of the last truly independent wholesale coffee dealers in the U.S., importing, roasting, blending, and distributing everything from raw green beans to branded ground coffee.

The business is split into three segments:

Wholesale Green Coffee – selling unroasted beans to roasters and coffee shops

Private Label – roasting and packaging for major chains and retailers under their own brands

Branded Coffee – seven proprietary brands across all price points

The company offers over 90 specialty coffee products, maintains decades-long customer relationships, and operates facilities in Colorado and Ohio. Unlike most players in the industry, they cover the entire value chain, from sourcing to packaging.

It’s been led by the Gordon brothers for over 30 years, who still own a meaningful stake and have navigated JVA profitably through every coffee cycle.

This microcap shot of espresso is pretty uncovered.

It only has 170 holders of record, no analyst coverage and no Wall Street hype.

But behind the scenes its a small, profitable, and growing business trading at a meaningful discount to intrinsic value.

The Numbers

This will be relatively unspectacular. So I will keep this as short as it can be.

Its not something where you gasp at 10x cash or a 90% NCAV Discount.

Just a solid Net-Net trading below liquidation value.

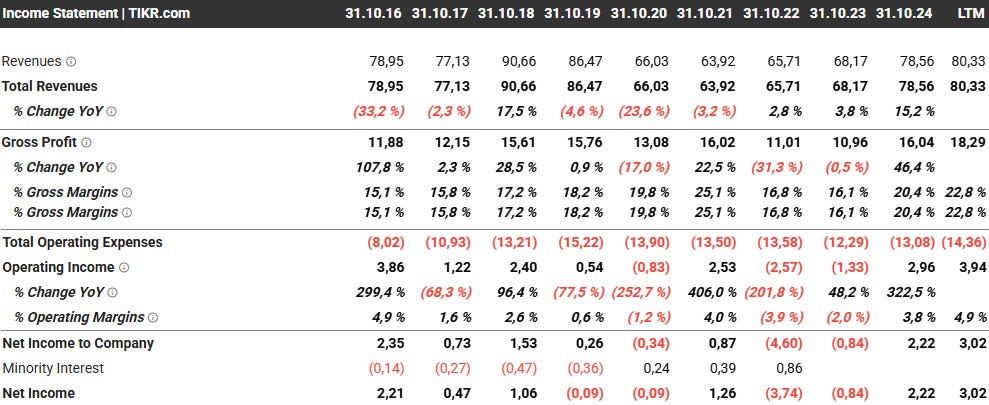

Let’s start by looking at the income statement:

→ Income statement excerpts

Over the past decade, revenue has stayed consistent, with a slight dip during COVID, followed by steady recovery since 2021.

Gross margins have improved thanks to pricing power and operational efficiencies, pushing both operating and net income to multi-year highs.

FY2024 ended on a strong note.

Gross profit rose 46%, driven by growth in packaged coffee and smart hedging activity.

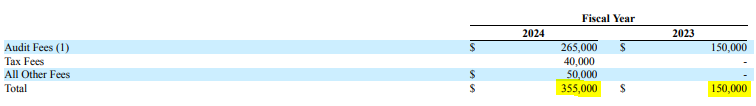

Earnings would have been even higher without a 135% increase in audit fees, mostly related to a failed reverse merger with Delta Corp Holdings.

The company also had an interesting recent acquisition which affected last year numbers:

In November 2024, Coffee Holding acquired the assets of much smaller competitor Empire Coffee for just $825k.

The deal brought them a fully operational turnkey manufacturing facility, additional roasting capacity, and a customer list, at what management calls “about $0.60 on the dollar.”

On its own, that’s a solid bargain purchase.

But more importantly, it enhances Coffee Holding’s private label operations and creates meaningful cost-saving opportunities across facilities.

CEO Andrew Gordon described the transaction as “a big win” and expects to recapture Empire’s lost customer base while capitalizing on the current industry bankruptcies. (more on that in a second)

While the acquisition temporarily dragged down quarterly earnings by $0.05 per share, the long-term upside is clear:

Lower costs, higher capacity, and the potential to win back market share, all acquired at a distressed price.

The CEO even stated:

„Although our recent acquisition of assets from Empire Coffee Company, Inc. negatively impacted our earnings by $.05 per share during this quarter, this was not an unexpected event. We have experienced improved revenue growth on a monthly basis since our transaction closed in November 2024, and we expect this trend will continue as we bring back Empire Coffee Company’s lost customer base and grow revenues back to the levels we envisioned prior to the transaction’s close. More importantly, the acquisition of Empire Coffee Company’s first-class manufacturing facility will allow us to begin soliciting and servicing additional business opportunities which have now become available due to the (…) bankruptcies within the local industry. We believe we are well-positioned to continue to grow the Company’s revenues and profits as we evaluate these new opportunities as they arise”

That’s a promising statement.

Now, back to the numbers.

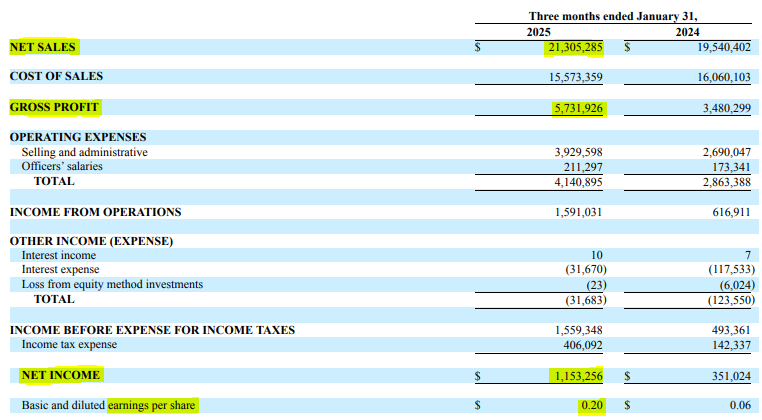

Looking at Q1/FY2025:

The reports came in pretty well.

Sales of $21.3 million were up by 9% compared to the same period last year and reported gross margin of 26.9% represented a new multi-year high.

EPS jumped 200% to $0.20 per share.

“The bull market in coffee continues to drive both revenues and profits, as we were able to build upon the successes achieved during Fiscal 2024”

Profitability would have been even better without the recent acquisition of Empire Coffee which recorded a loss of $0.3 million for the quarter.

Management also celebrated the results in a separate press release:

„Our favorable inventory position combined with our derivative strategy allowed us to remain competitive to all our customers during the quarter, as price increases to our wholesale customers combined with higher green coffee prices provided us with increased profitability to our overall customer base.

Sales of our flagship brand Café Caribe also grew 9% compared to first quarter of 2024, as we continue to take market share away from our competitors, as we believe customers find our brand to be more affordable in this high coffee priced environment“

A closer look at revenue reveals something interesting:

Hedging

A big portion of last quarter’s earnings, around $1.8M, came from hedging gains. Without them, JVA would’ve recorded a loss.

At first glance, that might sound odd, or even concerning. But I actually see it as a strength.

JVA uses futures and options to hedge volatility in green coffee prices. They’ve built this into their business model to protect margins and ensure inventory security, especially when coffee prices spike.

„Our hedging policies remain a vital element of our business model not only in controlling cost of sales, but also giving us the flexibility to grow sales while minimizing margin compression during times of historically high coffee prices.“

And prices have been rising.

Arabica futures jumped over 55%, Robusta nearly 40%.

So the $1.8M hedging gain makes sense.

As a side note: This is a very common thing to do in industries exposed to volatile input costs. Airline companies usually hedge jet fuel, for example.

But it’s rare in small caps.

Therefore JVA has a competitive advantage.

“Our favorable inventory position combined with our derivative strategy allowed us to remain competitive.”

Meanwhile, most of their competitors were hit hard:

“Record high prices in the coffee markets continue to hurt many of our competitors. Several high-profile bankruptcies were announced over the past months.”

And that opens the door for JVA:

“ We believe our hedging strategies put us in an excellent position to capture new business becoming available due to our competitors’ misfortunes.”

A sign of very competent Management here.

Now you may wonder, why they didn’t just increase their prices to make up for higher costs?

Well, they couldn’t … right away.

Pricing in this space is largely dictated by national brands. So JVA had to wait for the big guys to move first.

Which they eventually did. During the later half of fiscal Q4 of 2024.

“Even with commodity prices rising fast, we held off on price increases to supermarket and wholesale customers until the national brands raised theirs... which clearly had a negative effect on both revenues and earnings up until when the majority of these price increases were implemented.“

But now:

„Now, we believe that these increases, combined with an elevated Arabica futures market, should provide us with a strong tailwind heading into fiscal 2025.“

So we’re not looking at a stagnating microcap.

We’re looking at a nimble, well-positioned operator making smart, forward-looking moves.

With that clear, let’s turn to the balance sheet and valuation.

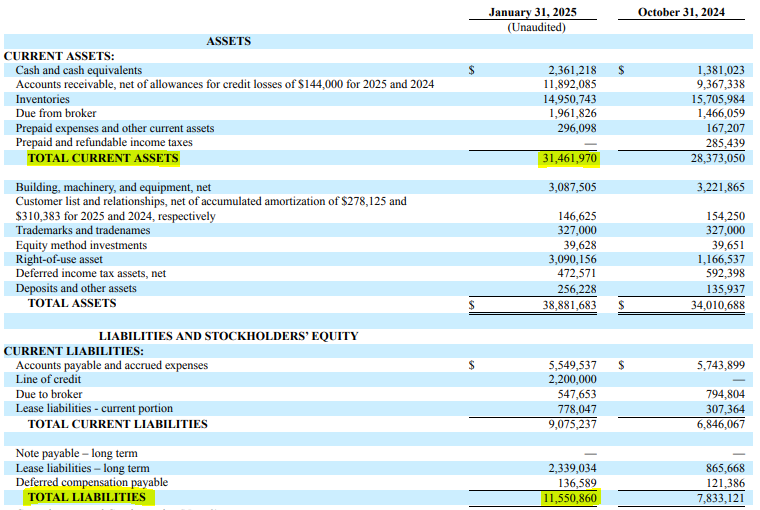

Balance Sheet & Valuation

Coffee Holding carries very little debt.

Yes, they recently took on a $2.2M line of credit, yet over FY2024, they repaid a total of $9.6M in debt.

„We strengthened our balance sheet, dramatically reducing our debt load even though interest rates remained elevated, as well as renegotiating our lease at our main offices in Staten Island, which will result in an annual savings of approximately $72,000 a year. “

If you put together all the numbers, there is something that doesn’t really make sense to me.

Despite the improved outlook, strong profitability, and conservative capital structure...

JVA is trading below NCAV.

Here is the math:

Net current asset value = total current assets – total liabilities

NCAV= $31,461,970 - $11,550,860

NCAV: $19,911,110

5,708,599 shares outstanding

NCAV per share: $3.49

Current market cap: $16.21M

Share price: $2.84

→ That’s a 19% discount to liquidation value.

Valuation-wise, Coffee Holding trades at bargain levels of just 0.2x estimated FY2025 sales and 4.5x Enterprise Value/Adjusted EBITDA, as compared to 3.5x and 17x for the U.S. beverage (soft) industry.

That said, with the company being a small player in a competitive industry, a substantial haircut appears justified.

But this isn’t just a haircut, it’s a deep discount.

Also most investable Net-Nets are stagnant, without any growth and most often just barely profitable, riding on asset value alone.

That’s not JVA.

It’s profitable & growing, with margin tailwinds and a catalyst-rich setup.

So yes, trading below NCAV might make sense for a dying retailer or a cash- burning biotech.

But for a stable, expanding family business like this?

That’s not really reasonable.

And yet, here we are.

Let’s talk about why.

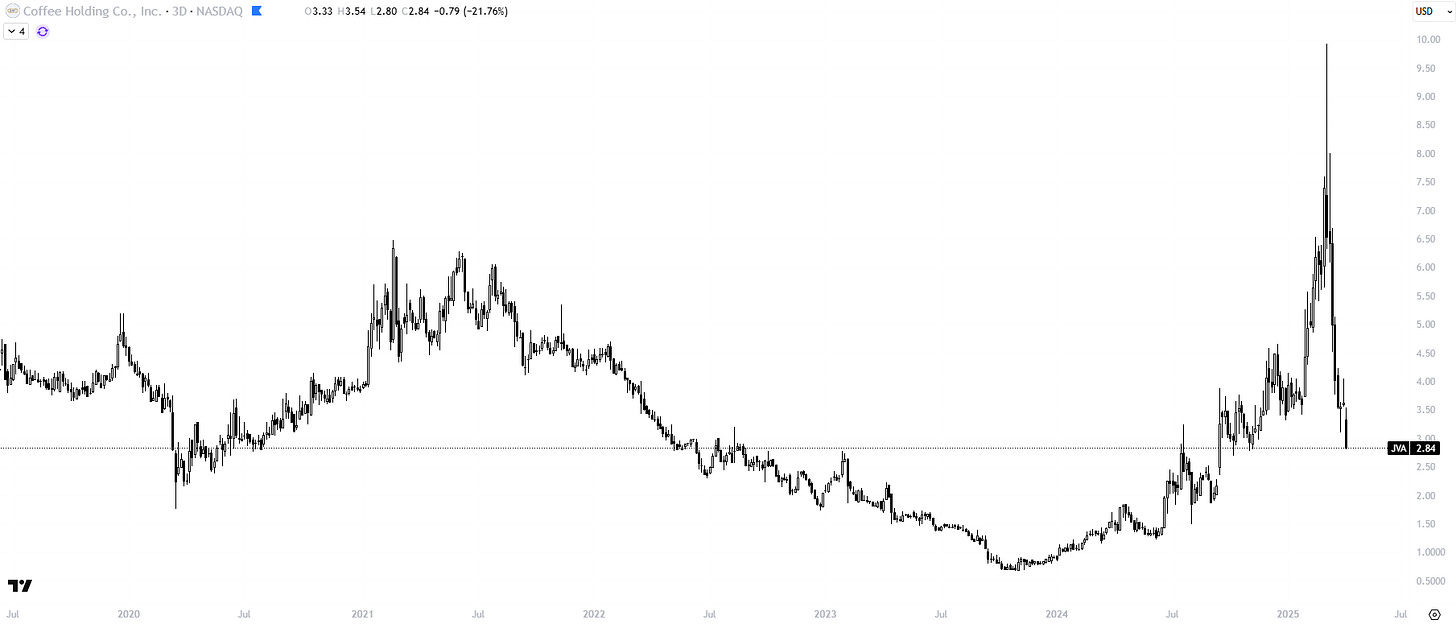

Recent price movements

At first glance, the chart looks a bit odd.

In February, the rally in Coffee Holding's stock accelerated on very high trading volume with the stock price peaking just shy of $10 on March 7.

However, momentum reversed just as fast. Within a week, the stock gave up more than 40%.

Here is why that happened:

Reason for the spike

Well, it’s simple, the company reported some pretty good news!

They openly talked about the highly favorable Empire Coffee acquisition and how they expect to benefit long term.

Shortly after they reported very good numbers for FY2024, along with a very positive near-term outlook.

So naturally, shareholders got excited. Rightfully so.

So why the sudden drop?

There were two key triggers:

1. A $30 million shelf registration.

A Shelf registration allows a company to register securities (like shares) or future issuance, without having to sell them right away.

For investors, that’s a mixed signal:

On the one hand: it adds flexibility

On the other: it opens the door for potential dilution if shares are later issued

Even though it makes sense for investors to get nervous, if you dig just one layer deeper, that concern quickly fades.

Here’s what management said:

"We recently filed a shelf registration statement with the SEC which, once declared effective by the SEC, will enable us to raise additional capital, if needed. Although we have ample room on our credit facility to tackle new opportunities which might arise, we believe the registration statement will give us additional flexibility in this current dynamic coffee market environment, as we could use our stock as currency rather than take on bank debt to finance new business opportunities. However, at the moment, we have no immediate plans or needs that would prompt us to utilize the registration statement."

They emphasized it’s a precaution, not a plan. So there’s no immediate reason to worry.

2. A late 10-Q filing:

The second factor: A delayed quarterly report.

According to their NT 10-Q:

“The Company was unable to file its Quarterly Report on Form 10-Q for the quarter ended January 31, 2025 within the prescribed time period without unreasonable effort or expense due to the delay in obtaining and compiling certain financial and other information necessary for the completion of the review of its financial statements.”

So it’s clear there’s no scandal behind this, just a delay, likely caused by internal accounting or organizational issues. Even if it’s a little embarrassing for the company, it’s not a big deal.

Both reasons for the sudden sell-off seem more noise than substance. To me, it looks like a classic overreaction by the market.

It may look odd on the chart.

But for rational investors, this is a real opportunity.

The sell-off wiped out all gains from earlier this year, pushing the valuation straight back into deep discount.

Reminds me of that classic Buffett quote:

„Be fearful when others are greedy, and greedy when others are fearful.“

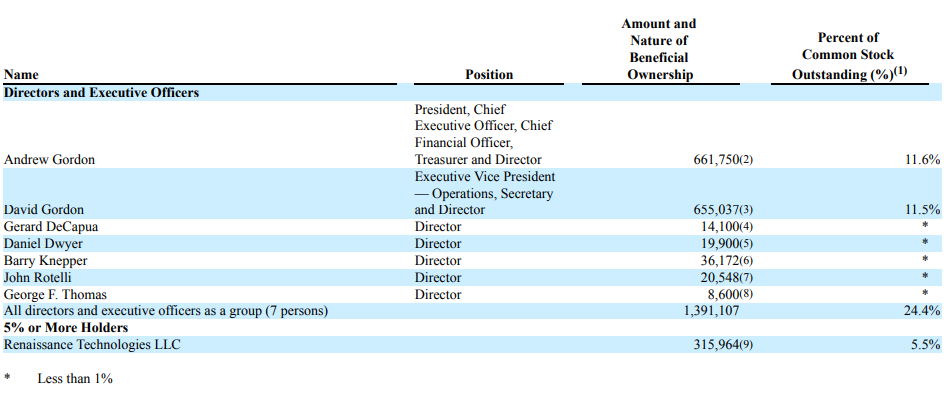

Ownership Overview

Insider ownership looks good to me. The Gordon brothers still hold a meaningful stake without having too much concentrated control.

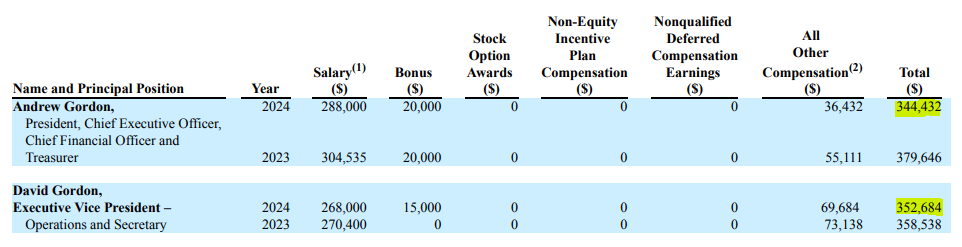

Their compensation also seems reasonable:

Andrew Gordon earned $344,432 last year.

David Gordon brought in $352,684.

It’s still a lot, both salaries reflect about 10% of net income, but it‘s not out of line and certainlynot a red flag.

What’s also interesting is who else owns shares.

Renaissance Technologies holds a sizable stake in the company.

The quant fund is known for its algorithmic strategies and exceptional long-term returns.

Its flagship Medallion fund, which is run mostly for fund employees, is famous for the best track record on Wall Street, with annualized returns of over 66% before fees and 39% after fees across three decades.

According to recent filings, they even added 65,000 shares, bringing their total stake to 6.6% of outstanding shares

And they’re not the only big name on the list.

According to their latest 13F filing Goldman Sachs recently opened a 27,408-share position as well.

Lastly, it’s worth pointing out something interesting regarding the recent price drop:

Last July, the Gordon brothers were buying shares at prices up to $2.4.

A level we’re now approaching again.

I'll just leave that here.

Risks

I don’t see many risks with JVA. It’s a solid, well-run business. But if I had to point out a few it would be the following:

1. Exposure to coffee prices & supply:

The company isn‘t immune to changes in the operating environment - despite its solid hedging practices.

The Supply and price of coffee beans are subject to volatility and are influenced by numerous factors like, weather, politics, currency swings, and economic conditions in exporting countries.

Yes, an increase in price can and will be passed on to the customers, but that doesn’t mean it’s risk-free. It may still affect the business as it could lead to a decline in overall consumption of coffee.

Similarly, if green coffee prices fall too quickly, they may have to lower sale prices before realizing cost reduction in purchases.

This brings us to the second risk.

2. Bad hedging outcomes:

Even though they recently profited from their hedging results. No strategy can entirely eliminate pricing risk. JVA still faces potential losses on its futures positions especially if coffee prices decline significantly in a short period of time.

They even stated in their 10-k:

„Although we have had net gains on options and futures contracts in the past, we have incurred significant losses on options and futures contracts during some reporting periods. In these cases, our cost of sales has increased, resulting in a decrease in our profitability or increase our losses.“

However management tries to reduce this risk, by optimizing its hedging strategy.

They have begun scaling back speculative trades and focusing on more conservative, strategic hedging:

„As a result of the volatile nature of the commodities markets, we have scaled back our use of hedging and short-term trading of coffee futures and options, and intend to continue using these tools in a limited capacity going forward.“

That’s another sign of thoughtful, adaptable management.

3. Customer concentration:

While sales are generally diversified across segments, there’s still some customer concentration risk.

„We had one customer that accounted for greater than 10% of our net sales during our 2024 fiscal year.“

The loss of which would definitely negatively definitely impact earnings, at least in the short term.

Final Thoughts

Coffee Holding is an interesting one, precisely because it isn’t.

It’s a simple business.

A simple, growing, and improving business run by competent management with decades of experience.

And yet, it trades below liquidation value.

Pushed into discount not by fundamentals, but by fear.

That, combined with its growth trajectory, makes the current mispricing a compelling setup for value investors.

As CEO Andrew Gordon put it:

„These continued efforts on our part to focus on ways to reduce our operating costs along with an expected continued growth trajectory in revenues, give me reason to believe that we will continue to execute as a company and give our shareholders the value that they have missed out on over the past several years.”

That’s the bet here.

A return to rational pricing.

Sidenote: Some of the numbers may no longer be fully up to date. I finished writing this piece before Trump’s “This is a great time to buy” tweet and the recent tariff announcements. In my experience, news-driven moves like these often correct themselves, especially when the fundamentals haven’t changed.

That’s why I’ve decided to publish this write-up as-is.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

Nice write up. I have looked and read about this company several times over the years, but it never seems to go anywhere. And I would be concerned about coffee prices going forward. So the hedging is a very big deal. Perhaps there is still one nice puff going forward. Or it could just be a value trap. I hope the former will occur. Thanks. Good work.

Thanks for the article. With coffee futures still elevated compared to pre-COVID, how would profitability look with pricing returning to 2019 levels?

I struggle to see their competitive advantage in a normalized environment, although the stock certainly looks cheap on a liquidation basis.