Every once in a while, you come across a stock that’s just too cheap to ignore.

Today‘s stock is exactly that.

A textbook Net-Net in the spirit of Ben Graham:

Trading at 0.68x book value

Cash exceeds market cap

Average revenue growth of 37.7% over the last five years

What Is a Net-Net?

A Net-Net is a stock trading below its Net Current Asset Value (NCAV).

NCAV = Cash + Accounts Receivable + Inventory - Total Liabilities

In simple terms, NCAV estimates a company’s liquidation value.

If the company collected its receivables, sold its inventory, paid off all liabilities, and shut down, the remaining amount would be what’s left for shareholders.

For a stock to qualify as a Net-Net, its NCAV must exceed its market cap—meaning the market values it as if it were worth more dead than alive.

Why Does It Work?

Most companies will never have an NCAV above zero—let alone one that exceeds their market cap.

Here’s why:

Current assets (cash, receivables, and inventory) are what a business expects to convert to cash within a year.

Total liabilities include both short-term and long-term obligations.

Imagine a company owns a mortgaged property. In the NCAV calculation, the property gets zero asset value (since it’s not a current asset), but the mortgage still counts as a liability.

For most businesses, this equation never results in a positive NCAV. And for a company to not only have a positive NCAV but also trade below it? That’s rare.

So why do net-nets work? Because, by definition, they are incredibly cheap.

It’s one of the most time-tested and proven strategies to outperform the market.

Benjamin Graham, Warren Buffett, and Joel Greenblatt all made money with Net-Nets.

It‘s not that simple

Just blindly buying every Net-Net that pops up in a screener isn’t a very good strategy. In fact, it may be a great way to burn capital.

As it turns out, markets are generally efficient.

Most Net-Nets trade below NCAV for a reason—they’re burning cash, piling on debt, or barely breaking even. Many will lose money until the equation flips, or worse, go bankrupt.

If you run a screener for net-nets, most results will be companies you’d rather avoid—busted biotech firms burning through cash, breakeven businesses sitting on niche inventory, or companies hit by a sudden disaster.

But every once in a while, you’ll find a hidden gem: a small, under-the-radar business sitting on net cash, making simple products, and consistently turning a profit.

These are the ones worth paying attention to.

Today’s stock is exactly that.

A company that has no business being valued more dead than alive.

And I’ll show you why.

The Company: Cronos Group (CRON)

The company I’m writing about today is Cronos Group, a Canadian-based global cannabis company focused on research, technology, and product development.

It operates across multiple international markets and is listed on both the Toronto Stock Exchange (TSX) and NASDAQ under the ticker CRON.

Many investors see Cronos as one of the safest ways to bet on the cannabis industry. And for good reasons—I‘ll get into those later.

That’s not why Cronos caught my attention.

To be honest, I’m not particularly excited about the cannabis market. I usually prefer “boring” industries with steady cash flows and predictable demand.

So why am I writing about Cronos?

Because it‘s trading at a huge discount!

Cronos is trading below its net current asset value (NCAV) while being a profitable, cash-rich business growing at an exceptional rate.

Before diving into the valuation and balance sheet, I first need to address the state of the Canadian cannabis industry—since this is where Cronos is headquartered and generates the majority of its revenue.

So let’s get into it:

The Canadian Cannabis industry

The cannabis sector has been a brutal place for investors.

Billions of dollars have been burned, stock prices have collapsed, and most publicly traded producers are down 90%+ from their highs.

Cronos is no exception.

But why has this industry been such a disaster?

When Canada became the first G7 country to legalize cannabis in 2018, there was an initial supply shortage, leading to soaring prices and an influx of capital. Companies rushed in, overbuilt production, and created massive oversupply— leading to a classic boom-and-bust cycle.

As a result, retail prices plummeted: The average price per gram fell from $11.78 (2019) to as low as $3.50 due to the massive oversupply.

The situation was made even worse by the excise tax trap:

Cannabis producers pay the greater of $1/gram or 10% per gram in taxes—a rate set when cannabis was expected to sell for $10/gram. Now that prices have collapsed, some producers pay 30%+ of their revenue in excise taxes.

The Turning Point

Conditions are starting to shift.

Industry-wide consolidation is underway, with bankruptcies, closures, and downsizings rapidly reducing supply.

40% of all corporate bankruptcies in Canada (2022) were cannabis companies, with another 12% of all filings in 2023.

Wholesale cannabis prices have been rising month-over-month, with current prices at ~$4/gram, according to the Canada Cannabis Spot Index (CCSI).

At the same time, pressure is mounting for excise tax reform.

The House of Commons has recommended changing the tax to a flat 10% ad valorem rate, which would make it more sustainable for producers. While it’s unclear if this will pass, at some point, the government will have to act—otherwise, they risk killing the industry entirely.

And they likely won’t want that to happen.

According to a Deloitte report, from legalization in 2018 through 2021, the cannabis industry contributed CAD$43.5B to Canada’s GDP and created 150,000+ jobs!

Both federal and provincial governments have benefited massively from tax revenue, with the report estimating CAD$15.1B in federal taxes alone.

What This Means for Cronos

Somewhat perversely, the longer it takes the government to make these changes, the better for Cronos.

While most cannabis companies are struggling to survive, Cronos is one of the few built to withstand this downturn. I’ll explain why in a moment.

Unlike highly leveraged peers, Cronos has strong downside protection—with a rock-solid balance sheet, hidden assets, and backing from a tobacco giant.

The longer this shakeout continues, the better for Cronos. Weaker competitors are wiped out, supply shrinks, and margins improve.

And if the industry rebounds?

Cronos will be in prime position to capitalize.

Outstanding growth

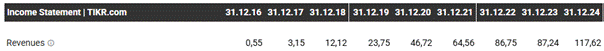

Despite the brutal market conditions of the past few years, Cronos has managed to achieve impressive revenue growth:

Since 2016: +95.55% CAGR

Last 5 years (2019–2024): +37.71% CAGR

·Last year (2023–2024): +34.82% CAGR

Gross revenue increased from $87M in 2023 to $117M in 2024, driven by higher domestic sales volumes and the expansion into Germany and Australia.

At the same time, Cronos has significantly reduced operating expenses—cutting $30M in costs in 2023, mainly from lower G&A and R&D expenses. The closure of its Winnipeg facility resulted in an additional $5M–$10M in cost savings in 2024.

Net Income & Cash Flow Turning Positive

Although the company has been earning a positive and growing gross profit over the last few years, it reported net losses until 2023.

That changed in 2024.

While the company still has a negative operating income, it turned net income positive in 2024 and also became free cash flow (FCF) positive. Notably, Cronos expects to further increase its net cash balance throughout 2025.

It’s worth mentioning that a significant portion of this cash flow—around $50M—comes from interest earned on its large cash reserves, as part of its funds are invested in bonds.

That being said, I think this is quite an attractive position to be in while facing both depressed market prices and the excise tax regime.

A Rock-Solid Balance Sheet

One of the standout features of Cronos' balance sheet is its massive cash position—$858.81M—with zero long-term debt.

As mentioned before, Cronos is a Net-Net stock, trading below its net current asset value (NCAV).

Let’s break down the numbers:

NCAV Calculation:

Net Cash: $858.81M

Accounts Receivable: $29.77M

Inventory: $47.54M

Total Current Assets: $936.11M

Total Liabilities: $55.33M

Net current asset value = Cash + Accounts Receivable + Inventory - Total Liabilities

Net current asset value = Current Assets – Total Liabilities

Net current asset value= $936.11M – $55.33M = $880.78M

A net current asset value of $880.78M translates to a Net-Net price per share of $2.30, compared to the current share price of $1.90.

Current Market Cap: $724.59M

Discount to NCAV: 17.72%

This means Cronos is trading at a 17.72% discount to its liquidation value—all while maintaining a strong cash position and zero long-term debt.

That’s a rare setup in today’s market.

Hidden assets

In addition to its strong cash position, Cronos holds several overlooked assets that could be monetized.

This includes real estate holdings, such as the Stayner facility, which was recently sold for $17 million, and the Winnipeg fermentation facility, which is currently listed for sale.

Beyond real estate, Cronos also has strategic equity stakes in profitable businesses.

The company owns 50% of Cronos GrowCo, a joint venture that generates consistent interest income. Additionally, it holds a 6.3% stake in PharmaCann, one of the largest private multi-state cannabis operators in the U.S., as well as a 10% stake in Vitura, a leading Australian medical cannabis provider.

It should be clear that the true value of Cronos extends far beyond its balance sheet.

These hidden assets reinforce the fact that Cronos has significantly more intrinsic value than the market currently reflects.

The Altria Partnership: A Game-Changer

By now, you might be wondering how an unprofitable cannabis company managed to accumulate an $860 million net cash balance.

The answer lies in a strategic investment from Altria, the $100 billion tobacco giant.

In 2019, Altria invested $1.8 billion for a 45% stake in Cronos, implying a valuation of $4 billion at the time.

With this deal, Altria secured the right to nominate four out of Cronos’ seven board members and obtained approval rights over significant transactions.

This wasn’t just some passive investment.

It was a calculated move by one of the biggest players in the tobacco industry.

Altria’s involvement is crucial for multiple reasons.

First, it provides Cronos with an unparalleled financial advantage. While most cannabis companies are struggling with cash burn and resorting to expensive financing just to stay afloat, Cronos is earning over $50 million annually in interest alone. This cost-of-capital edge ensures its survival, no matter how long it takes for market conditions and regulations to improve.

But the real significance of this partnership goes far beyond financial stability.

If you read between the lines, it’s clear that Altria—like other Big Tobacco giants—is positioning itself to dominate the cannabis industry.

However, given the current regulatory landscape in the U.S., Altria needs a proxy to make inroads into the sector.

That proxy is Cronos.

Once federal legalization becomes a reality, Cronos is likely to be absorbed into Altria as its dedicated cannabis division.

This backing from Big Tobacco not only solidifies Cronos’ position in Canada but also gives it a massive advantage in capturing U.S. market share when the opportunity arises.

Taking this into account, the upside potential looks far greater than what the current valuation reflects.

Another thing I like about Cronos is its management team:

Management

Cronos isn’t just another cannabis company run by a couple of industry outsiders.

It has a seriously competent management team backed by deep industry connections and strategic investors.

The company is led by Mike Gorenstein, who serves as Chairman, President, and CEO.

Gorenstein isn’t your typical cannabis executive.

He has an investing background as a founder of Gotham Green Partners, a cannabis-focused private equity firm, as well as a legal background as a former M&A attorney at Sullivan & Cromwell.

Gorenstein and his partner at Gotham, Jeff Adler, who also sits on Cronos’ board, collectively own around 6.5% of the company.

And then there’s Altria, which controls 4 out of 7 board seats. Given that Altria is a $100 billion giant, you can assume the people they’ve placed in these seats bring serious experience and expertise. If Cronos is being steered with Altria’s influence, it’s safe to say they’re thinking long-term and strategically.

Acquisition Talks

Another thing worth mentioning about Cronos are the acquisition talks:

Last year, there were rumors that Cronos was looking to sell the company to Curaleaf.

Although that didn't manifest, it is interesting for a number of reasons.

1. Cronos is sitting on $860M in cash from the Altria deal, more than any other cannabis company. That alone makes it an attractive acquisition target.

2. Any company acquiring Cronos would instantly improve its financial position with this capital infusion.

3. This is key: Altria, which owns over 40% of Cronos, has an exclusive agreement that restricts its cannabis-related ventures to Cronos. If any major cannabis player wanted to work with Altria, acquiring Cronos would be the only way in.

Whether Altria chooses to expand Cronos aggressively, increase its stake, or if another industry player steps in, the company’s strategic positioning and cash-rich balance sheet make it a compelling asset in the sector.

Risks

The biggest risk here is capital allocation.

Right now, we have the opportunity to buy Cronos at a material discount to NCAV.

That discount could disappear quickly if management makes poor decisions. A company sitting on a massive cash pile can easily destroy value through bad acquisitions, excessive spending, or ineffective strategic moves.

That being said, the risk seems relatively low given that:

Cronos is trending cash flow positive, meaning it’s no longer bleeding cash like many other cannabis companies.

Interest income alone from its cash balance is generating a substantial return.

For this risk to truly materialize, management would have to fail in generating any meaningful return on that cash over time, while the core business simultaneously deteriorates further.

Given the competence and financial background of the management team, I consider this risk quite remote.

Final Thoughts

Most people looking at Cronos (CRON) see it as a safe way to play the cannabis sector because, due to its balance sheet strength, it’s one of the most secure players in the field.

I see it first and foremost as a valuation play.

Yes, there’s upside potential if cannabis regulations shift and the market expands. But the real opportunity here isn’t just about industry speculation.

It’s about buying a profitable, growing company with a rock-solid balance sheet for less than its net current asset value (NCAV).

A business like Cronos shouldn’t be trading below liquidation value, and that’s what makes this a deep value, asymmetric bet.

And if the bull case for cannabis does play out?

Then the upside could be far greater.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.