Key Metrics:

Market Cap: $207M

Enterprise Value: $73.7M

EV/EBIT: 3.03x

P/E Ratio: 5.77x

Zero long-term debt

Massive cash reserves

Trading below book value

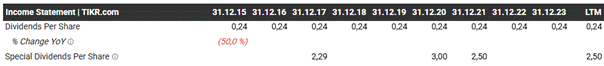

Consistent dividends for 17 years

Special dividends every few years

At first glance, today’s stock doesn’t look very exciting.

It’s a no-growth, illiquid micro-cap operating in renewable energy and specialty chemicals.

Hardly the kind of business that turns heads on Wall Street.

It hasn’t even held an earnings call since 2015, and not a single sell-side analyst covers the stock.

But that’s exactly what makes it interesting.

Warren Buffett has often said that if he were managing a small portfolio, he could achieve 50% annual returns by investing in overlooked, underfollowed companies.

Stocks that are too small for institutional investors but deeply undervalued by the market.

That's exactly what today’s company is.

FutureFuel Corp. (NYSE: FF)

FutureFuel is about as "under the radar" as it gets.

No analyst coverage.

No earnings calls.

No Wall Street hype.

Just a cash-rich, profitable business trading at absurdly low valuations.

The company operates in the specialty chemicals and biodiesel industry, manufacturing biodiesel and various chemical products.

Unlike many public companies that aggressively push for higher share prices through investor relations and PR campaigns, FutureFuel operates more like a private business.

That’s because a significant portion of ist shares is still held by management, insiders, and legacy shareholders, reinforcing a long-term ownership mindset.

As a result, management isn’t focused on impressing Wall Street.

They’re focused on running the business.

FutureFuel is headquartered in St. Louis, Missouri, but its main operations take place at a 2,200-acre facility near Batesville, Arkansas.

This vertically integrated site includes production plants, R&D labs, and waste management systems, distributing products via truck, rail, and barge.

The company also maintains additional warehouse facilities in Little Rock, Arkansas.

Let’s take a look at how FutureFuel earns its money:

FutureFuel operates in two primary business segments:

Specialty chemicals and biofuels.

While both divisions are crucial to the company’s overall operations, the biofuel segment is by far the largest revenue driver, accounting for approximately 69% of total revenue, with the chemical segment making up the remaining 31%.

Let’s break it down a little further:

FutureFuel’s specialty chemicals division is a stable, high margin, contract-driven business built on long-term agreements.

This segment is divided into two key areas:

Custom Manufacturing (26% of revenue): Here FF produces highly specialized chemicals for specific customers under long-term contracts. These chemicals are used in agriculture, energy, coatings, and industrial applications.

Performance Chemicals (5% of revenue): which consists mostly of biocides, stabilizers, and dyes.

What makes this segment particularly attractive is the high barrier to entry.

Manufacturing specialty chemicals requires extensive expertise, regulatory approvals, and expensive infrastructure, making it difficult for new competitors to break in.

A great example of this competitive moat is Procter & Gamble's failed attempt to bring bleach activator production in-house.

This highlights how complex and entrenched these operations are, forcing even global giants to rely on suppliers like FutureFuel.

One thing I like a lot is that FutureFuel keeps investing in innovation.

While many companies cut R&D spending to boost short-term profits, FutureFuel continues to develop high-margin products and improve efficiency, helping protect long-term margins.

While this segment provides steady cash flow and strong margins, the real growth engine is FutureFuel’s biofuels division.

FutureFuel’s biofuels segment drives 69% of total revenue, primarily through biodiesel production and blended fuel sales.

One key advantage of FF is its cost flexibility.

Unlike competitors that rely heavily on expensive soybean oil, FutureFuel can process multiple feedstocks, including animal fats, recycled oils, and vegetable oils.

This allows the company to source the cheapest available inputs and keep margins intact, even in a volatile market.

To further hedge against price swings, FutureFuel pre-purchases feedstock when prices are favorable, reducing exposure to sudden cost spikes.

That said, government incentives play a role in profitability.

I’ll keep this short: FutureFuel benefits from two key incentive programs

1. Renewable Identification Numbers (RINs)

For every gallon of biodiesel sold, FutureFuel generates 1.5 RINs—essentially tradeable credits that prove renewable fuel was used.

These credits can be sold separately or used by fuel companies to meet government-mandated renewable fuel quotas.

As of September 30, 2024, FutureFuel held 5.0 million RINs valued at $2.56 million—a small fraction of the company’s $273.84M in LTM revenue but still a useful extra income stream.

2. Blender’s Tax Credit (BTC)

Historically, biodiesel producers received a $1 tax credit per blended gallon.

Though this subsidy has expired and been reinstated multiple times, it will be phased out in 2025 and replaced by the Clean Fuel Production Credit (CFPC), which bases payouts on carbon intensity scores rather than fixed per-gallon subsidies.

Even though the biofuels segment is more volatile than FutureFuel’s specialty chemicals business, when biodiesel prices and government incentives align, the upside is massive.

Now to the fun part:

The Valuation

Yes, a no-growth, illiquid micro-cap in the renewable energy and chemical industries isn’t particularly exciting.

Yet, from a valuation standpoint, FutureFuel is a statistical anomaly.

The company is highly profitable, generates strong free cash flow, carries no long-term debt, and sits on a massive cash pile.

All while trading below book value!

One of the most striking aspects of FutureFuel is its balance sheet strength.

The company currently holds $133.4 million in cash, which accounts for 66% of its entire market cap ($207M).

With zero long-term debt, FutureFuel is in an extremely secure financial position, with very little bankruptcy risk.

This financial stability allows FutureFuel to maintain consistent dividend payments, with a regular dividend of $0.24 per share (5.1% yield at current prices).

Dividends have been paid uninterrupted for 17 years, totaling $748.1 million over that period.

But do you know what really makes FutureFuel interesting?

The special dividends.

FutureFuel generates so much cash, they pay out massive special dividends every few years.

And I’m not talking about pocket change.

The most recent special dividend in May 2024 was a $2.50 per share payout, a 50% yield at the time!

Because of these huge payouts, the average shareholder yield over the past five years (at today’s price) has been nearly 40% per year.

That’s just insane.

FutureFuel is also trading at incredibly low valuation multiples, even when compared to its industry peers:

EV/EBIT: 3.03x (Industry Avg: ~10-12x)

P/E Ratio: 5.77x (Industry Avg: 12.2x)

P/B Ratio: 0.97x (trading below book value)

EV/FCF: 1.65x – an almost unheard-of valuation for a profitable, debt-free company.

These numbers suggest that FutureFuel is priced as if it were a struggling business, despite its stable revenue, steady profitability, and fortress balance sheet.

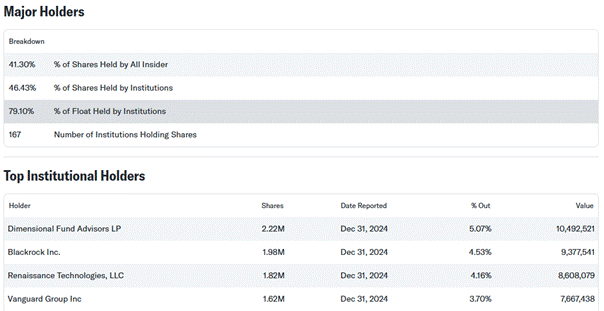

One factor suppressing valuation is likely liquidity.

41.3% of shares are held by insiders, including major shareholder Paul Novelly II, who owns 39.04%.

Another 46.43% of shares are institutionally held, with Vanguard and BlackRock among the top holders.

Source: https://finance.yahoo.com/quote/FF/holders/

This leaves only a small float available for trading, making it difficult for large funds to invest.

While Wall Street largely ignores FutureFuel, management clearly believes in the company.

Insiders have been actively buying shares, with purchases in the $4.35 – $6.10 range throughout last year.

I really like that.

When the people running the business are accumulating stock, it usually means one thing:

They believe the stock is undervalued.

And they aren’t just buying shares—they’re planning to shrink the share count too.

In early 2024, FutureFuel authorized a $25 million share repurchase program—equivalent to 11.54% of the company at today’s price.

I like that even more!

The only problem: not a single share has been bought back… Yet!

This reminds me of a message Michael Burry posted on SiliconInvestor.com back in the day:

“Precisely why I wish to evaluate companies in the midst of proven buybacks. Small marginal companies have taken to using buyback announcements as a publicity stunt to support their stock. More often than not, the buybacks do not materialize.”

I don’t like that.

Let’s see how this plays out.

Opportunities & Risks – What Lies Ahead for FutureFuel?

Like any investment, FutureFuel comes with both opportunities and risks.

While the company is financially strong and deeply undervalued, certain external factors could influence its long-term outlook.

Let’s break it down.

Opportunity 1: Rising Demand for Renewable Energy

The world is moving toward cleaner energy, and governments are pushing hard for biofuel incentives.

As long as biodiesel remains a priority in energy policies, FutureFuel stands to benefit from steady demand.

That being said, subsidies are critical—and if policies shift in favor of electrification over biofuels, this advantage could weaken.

Opportunity 2: Expanding into High-Margin Chemical Markets

FutureFuel’s chemicals division has been a stable cash generator for years.

Now, it’s actively expanding into higher-margin sectors like:

Pharmaceuticals

Food-grade chemicals

Advanced industrial applications

If successful, this shift could diversify revenue streams and reduce dependence on the more volatile biofuels segment.

Risk 1: Revenue Volatility.

FutureFuel’s revenue is closely tied to commodity prices, particularly:

Crude oil & diesel prices – Since biodiesel competes with petroleum-based fuels, its price tends to fluctuate with oil markets.

Feedstock prices – Rising input prices can squeeze margins, especially if biodiesel prices don’t rise at the same rate.

While the company’s hedging strategy provides some protection, volatility remains a core risk in its business model.

Risk 2: Regulatory & Subsidy Uncertainty

FutureFuel’s biofuels business relies on key incentives like RINs and the Blender’s Tax Credit (BTC).

These subsidies won’t last forever—and the BTC is already set to be replaced by the Clean Fuel Production Credit (CFPC) in 2025.

While subsidies don’t make up the bulk of FutureFuel’s revenue, they still play an important role in overall profitability.

If they were to disappear, margins would likely take a hit.

Final Thoughts

Markets are often thought to be efficient.

In reality, they are anything but.

Especially in small, illiquid corners that institutions ignore, mispricings can persist for years.

FutureFuel is a perfect example.

It’s cash-rich, profitable, debt-free, and has a strong dividend track record. Yet, it trades at just 3x EV/EBIT and below book value.

The market won’t always correct these inefficiencies overnight.

But for those willing to do the research and remain patient, FutureFuel represents a rare opportunity to capitalize on market mispricing.

It may not be the most exciting stock, but at these levels, FutureFuel looks like an asymmetric bet for patient investors.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

You might like Calumet (CLMT) as well. They operate in a similar space.

This is a big bet on the Trump admin not removing the tax credits though. There should be lots of Republican support for Biofuels production as many red states benefit from the industry, but Trump has it's own goals.. I think your write-up doesn't focus enough on this key risk and the potential impact.

"FutureFuel is headquartered in St. Louis, Missouri, but its main operations take place at a 2,200-acre facility near Batesville, Arkansas" Not operating at the moment as not profitable.