Key Metrics:

Market cap: $25.32M

Trading at 0.45x book value

52% of market cap in cash

No long-term Debt

After graduating from Columbia Business School, a 21-year-old Warren Buffett spent his days at a small Omaha brokerage firm flipping through the Moody’s Manuals—thousands of pages of financial data on every listed company.

He read them cover to cover. Twice.

Why? Because hidden among thousands of stocks were tiny, illiquid businesses trading at absurd discounts. Stocks so small that institutions ignored them. Stocks where a little research could turn up life-changing opportunities.

From 1952 to 1962, Buffett compounded his net worth at 48% annually by finding these hidden gems.

That kind of mispricing still exists today—just not in the large caps everyone’s watching.

Today’s stock is exactly the kind of business Buffett would have circled in his Moody’s Manual.

A deeply undervalued, cash-rich Net-Net.

Ignored simply because it’s too small for institutions to care.

But for individual investors willing to do the work, that’s exactly what makes it interesting.

What’s a Net-Net – and Why It Matters

A Net-Net is a company trading below the value of its net current assets. That’s:

Cash + Receivables + Inventory – Total Liabilities.

In other words, if the business shut down today, sold off its inventory, collected its cash, paid all bills—and handed what’s left to shareholders—you’d walk away with more than the current stock price.

Meaning the market values it as if it were worth more dead than alive.

And while most Net-Nets are uninvestable—think cash-burning biotechs, zombie retailers, or inventory-heavy distributors—every once in a while, you stumble across something different:

A tiny business.

Still profitable.

No debt.

Plenty of cash.

Totally ignored.

Benjamin Graham loved these setups. So did early Buffett.

They don’t show up often. But when they do, they’re worth paying attention to.

Tandy Leather Factory (NASDAQ: TLF) – A Forgotten Niche Leader

Tandy Leather Factory is a simple business that’s been around for 100+ years.

It’s a tiny, overlooked nanocap with no Wall Street coverage, almost no institutional ownership, and a share price that’s been largely ignored for years.

It‘s so uncovered, it only has 273 shareholders.

Beneath the surface, Tandy is quietly profitable, generates consistent free cash flow, and has zero long-term debt.

It dominates a unique and Amazon-resistant niche: leathercrafting.

Headquartered in Fort Worth, Texas, the company sells leather, tools, dyes, hardware, and DIY kits through 91 U.S. stores, 10 in Canada, and one in Spain.

Tandy’s business is built around hobbyists and artisans who want to touch, feel, and work with leather in person.

A market that e-commerce struggles to serve.

This hands-on nature has built a loyal customer base, with stores offering workshops, personalized help, and a steady stream of repeat buyers.

Despite weak recent stock performance and some e-commerce headwinds, the company has actually been improving.

It has been reducing its store count while increasing revenue per location, cutting costs, and buying back shares. The board recently approved a $5M buyback program through 2024, a significant move for a company of this size.

Tandy isn’t a high-growth story.

And it doesn’t need to be!

It’s a stable, cash-rich, overlooked business trading well below liquidation value.

Exactly the kind of setup deep value investors are looking for.

Valuation

For Benjamin Graham die-hards, Tandy’s balance sheet reads like a dream.

No goodwill. No intangibles. Just cash, inventory, and receivables.

A straightforward, hard-asset business with no long-term debt. Exactly the kind of setup that defined Graham’s Net-Net strategy.

Let’s walk through the numbers to see just how underpriced it really is.

NCAV Calculation

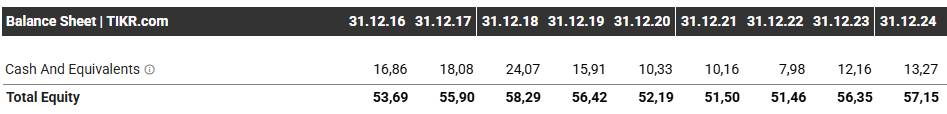

At its last quarterly report (31.12.2024) TLF had $13.27M in net cash; $0.72M in accounts receivable; $35.56M in inventory and $1M in other current assets, which equals $50.54M in total current assets.

If we subtract the $17.77M in total liabilities we get a net current asset value of $32.77M

Total Current Assets: $50.54M

Total Liabilities: $17.77M

Net current asset value = Current Assets – Total Liabilities

Net current asset value= $50.54M – $17.77M = $32.77M

Divide that by 8,496,581 shares outstanding, and you get a net-net value of $3.86 per share.

Today, the stock trades at $2.98.

Current Market Cap: $25.32M

Discount to NCAV: 22.7%

This means TLF is trading at a 22.7% discount to its liquidation value—all while sitting on a strong cash position and carrying zero long-term debt.

That’s a rare setup in today’s market.

But it gets better.

Impact of the Headquarters Sale & Special Dividend

Since the last quarterly report, Tandy Leather’s balance sheet has undergone a major transformation following the sale of its headquarters and the subsequent special dividend payout.

This transaction has not yet been fully reflected in reported financials, so let’s break down what it means for the company’s valuation:

Tandy sold its headquarters for $26.5 million, a significant premium to its book value of ~$5 million factoring in depreciation.

After deducting estimated taxes, fees, and relocation costs, the net proceeds likely came in around $15 million.

This transaction materially improved book value, as the real estate was carried on the books at a heavily depreciated value.

While this sale strengthened Tandy’s financial position, Tandy immediately returned most of it to shareholders through a $1.50 per share special dividend—a $12M payout.

The ex-dividend date was February 19th, and prior to the dividend, Tandy’s stock was trading at $5.42.

After the stock went ex-dividend, it opened at $3.69—a drop of $1.73, slightly more than the $1.50 per share dividend payout. By market close, it had recovered somewhat to $3.96, down $1.46 from the previous day.

This disproportionate drop suggests a possible mispricing—normally, a stock should decline by the exact amount of the dividend paid.

However, because much of the real estate value was not reflected on the balance sheet, the market may have overreacted to the payout.

Now let’s adjust the NCAV to reflect these changes.

Factoring in the sale and dividend, Tandy’s adjusted balance sheet now should look stronger than before.

The balance sheet should still reflect the $13.3 million in cash from before the sale.

In addition, it should include estimated net proceeds from the real estate sale of around $15 million.

That brings the total cash post-sale to $28.3 million.

If you subtract the $12 million special dividend, the adjusted cash balance post-dividend should be about $16.3 million.

The company still holds $35.5 million in inventory and $1.7 million in other current assets, bringing total short-term assets to $53.5 million. With total liabilities at $17.77 million, the post-dividend NCAV should sit at ~$4.20 per share.

At a current stock price of $2.98, Tandy is trading at a 29.2% discount to its adjusted liquidation value.

An even deeper discount than before the headquarters sale.

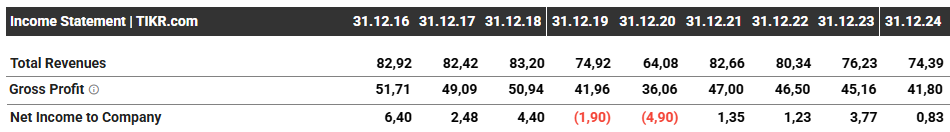

Earnings

In 2024, Tandy Leather reported a 2.4% decline in revenue. Gross profit came in at $41.8 million, while net income dropped to $0.83 million.

Down sharply from $3.77 million the year prior.

Yes, margins are thin. And earnings fluctuate.

But that’s the nature of the business. Tandy isn’t a high-margin, high-growth operation. It’s a stable, cash-generating niche retailer with a lumpy but positive earnings profile.

More importantly, the company remains financially sound. Which provides a pretty big safety net.

It finished the year with $13.27 million in cash—up from $12.2 million—zero long-term debt, and equity increasing to $57.15 million.

For a business with a current market cap of just $25 million, that’s a lot of financial flexibility.

Could earnings improve? Absolutely.

If Tandy returns to its 10-year average EBITDA of $6.8M, and even if we apply a modest industry multiple, there’s substantial upside. But that’s just icing on the cake.

The real story is this:

You're buying a debt-free, cash-rich, profitable business—trading below liquidation value. If earnings improve, great. If not, Tandy still provides hard assets backing you up.

Ownership – Management Has Skin in the Game

What I also really like about Tandy is, that it‘s heavily insider-owned.

With management and key investors controlling nearly 60% of outstanding shares.

Chairman Jefferson Gramm holds the largest stake at 34.4%.

James Pappas of JCP Investment owns another 10.0%.

Eric Speron of First Foundation holds 10.0%.

CEO Janet Carr holds 4.5%, giving her skin in the game as well.

When insiders are this deeply invested, incentives are aligned. You don’t need to wonder whether they care about the share price—they do. A lot.

And we’ve already seen that mindset in action:

After the company sold its headquarters, Chairman Gramm pushed for a portion of the proceeds to be returned to shareholders as a special dividend.

It’s also worth noting: only 40% of shares are in the float.

Where It Goes From Here

Tandy isn’t chasing headlines.

It’s quietly doing what smart companies should do: cutting dead weight, improving margins, and doubling down on what works.

After a century in business, the company knows its niche—and it’s not trying to be something it’s not.

Leathercrafting may be a sleepy corner of the market, but Tandy owns it. It has the scale, supplier relationships, and brand loyalty that smaller competitors simply can’t match.

In fact, some rivals even buy inventory directly from Tandy.

At the same time, management has shifted focus from growth-at-all-costs to operational efficiency.

It’s been closing underperforming stores, improving per-store economics, and boosting margins.

E-commerce now accounts for 18% of sales, and the company’s gross margin has consistently hovered around 60%.

Not bad for a supposed “legacy” retailer.

That said, this isn’t a risk-free bet.

Tandy still runs on thin margins, with 80% of its assets tied up in inventory. A slowdown in demand, or any major spike in labor or logistics costs, could hurt.

And while Amazon hasn’t cracked this niche yet, it’s always a looming threat.

But here’s the thing:

If Amazon were going to kill Tandy, it probably would have done so by now.

Instead, Tandy has improved profitability and maintained a fiercely loyal customer base. Why?

Because leathercrafting isn’t something you order in two clicks. People want to touch the material, get advice, take a class.

That’s hard to replicate online.

Add to that a pristine balance sheet, no long-term debt, consistent free cash flow, and a management team with real skin in the game, and you have a company built to endure.

Tandy doesn’t need to reinvent itself. It just needs to keep doing what it’s doing: staying lean, staying focused, and returning value to shareholders.

Whether through buybacks, dividends, or price simply coming back to fair value, there’s more than one way this story could play out.

Closing Thoughts

If Warren Buffett were flipping through the Moody’s Manual today, I have no doubt he’d have circled Tandy Leather.

It’s exactly the kind of company he built his fortune on: small, simple, ignored—and trading at a price that makes no sense.

A stable, cash-rich business with no long-term debt. Real assets. Real earnings. And manament that’s clearly aligned with shareholders.

This isn’t a flashy stock.

It won’t show up on CNBC.

But for patient investors willing to dig a little deeper, it just might be one of those rare opportuties hiding in plain sight.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

I was eyeing them since the end of last year, but got no time to understand the business. Thanks for writeup.

It could also be seen as a company divesting (shutting down stores, selling hq), paying its board and executives large special dividends and not re-investing a dime into the business. They could be quietly preparing to shut down the whole company based on what the story says.