Mistakenly Undervalued

Key Metrics:

EV/EBIT: 7.3

P/E: 6.19

Q3 YoY Revenue Growth: 70%

Q3 YoY Adjusted EBITDA Growth: 64%

Strong Cash Position

No Long-Term Debt

The Company:

Gigacloud Technology Inc. (NASDAQ: GCT)

What is Gigacloud?

Gigacloud is a B2B marketplace specializing in cross-border e-commerce and logistics for large, bulky goods—mainly furniture and home equipment.

The company connects manufacturers, primarily based in Asia, with resellers in the U.S., Europe, and Japan.

Unlike traditional logistics providers, Gigacloud offers an end-to-end solution, managing the entire supply chain from product sourcing to last-mile delivery. Its ability to move large items at a fixed, competitive rate makes it easier and cheaper for resellers to sell bulky products without dealing with logistical complexities.

Here’s where things get interesting—Gigacloud has almost no direct competition.

Most major e-commerce platforms don’t want to deal with the headaches of large-item logistics—high storage costs, complex fulfillment, and shipping challenges.

That’s why you rarely see an Amazon Prime tag next to furniture listings. While Alibaba B2B, Amazon, Temu, and Shein focus on smaller consumer goods, Gigacloud dominates the B2B marketplace for bulky items.

Aside from two small startups, Faire.com and Xceptions, Gigacloud is essentially a hidden monopoly in its niche.

How does Gigacloud make Money?

Gigacloud has three main revenue streams:

GigaCloud 3P (28% of total revenue) – A B2B marketplace where third-party sellers list and sell their products, while Gigacloud handles logistics, warehousing, and fulfillment. The company earns revenue through platform commissions and additional services like ocean freight, packaging, and last-mile delivery.

GigaCloud 1P (43% of total revenue) – Gigacloud’s own inventory sales, where it sources and sells products directly through its platform.

Off-Platform E-Commerce (29% of total revenue) – Sales of Gigacloud’s own inventory through third-party platforms like Amazon, Wayfair, and Home Depot.

What Makes Gigacloud So Unique?

Gigacloud’s biggest advantage is its logistics scale and supplier relationships.

The company operates 33 warehouses across the U.S., Canada, Europe, Japan, and China, seamlessly handling large-item logistics at a flat rate.

Resellers get predictable costs, and manufacturers can sell globally without building their own logistics network.

The barriers to entry are massive—just building the warehouses alone would cost a competitor at least $80M, plus another $100M+ in inventory and working capital.

Even if a competitor were to somehow build the physical infrastructure, they would still lack Gigacloud’s deeply entrenched supplier relationships and local expertise, which form the backbone of its competitive edge.

While publicly listed and headquartered in the U.S., most of its workforce and supply chain operations are based in China.

Alright, now that we’ve got the details covered, let’s get to the fun part:

The Valuation

Even though Gigacloud is relatively new to public markets, it’s far from a new business.

CEO Larry Wu has spent over a decade building the company into a key player in global B2B logistics. Initially a retailer, Gigacloud pivoted to a wholesale and marketplace model in 2019, launching the GigaCloud Marketplace—and that changed everything.

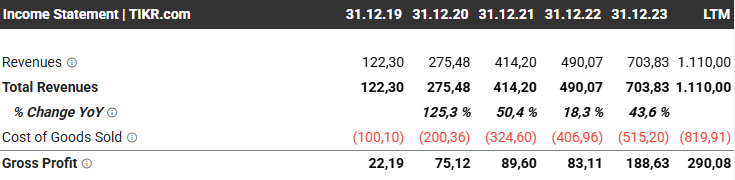

Since then, the company has exploded in growth:

Revenue surged from $122M in 2019 to $703M in 2023

Last twelve months (LTM) revenue stands at $1.11B!

Free cash flow exceeds $120 million

Debt-free, aside from long-term warehouse leases

Over $200 million in cash reserves

Recently announced a $46M share buyback program!

And yet, Gigacloud’s market cap sits at just $803M.

What the heck?

It’s currently trading at just 6.19x earnings and an EV/EBIT ratio of 7.3. That’s low on its own, but when you factor in 70% revenue growth, this valuation makes zero sense.

So why is Gigacloud so undervalued?

One reason: an aggressive short-seller campaign.

Led by Grizzly Research, which published a 90-page report in May 2024, accusing GCT of fraud and financial manipulation.

Grizzly Research is a short-selling firm that profits when a company’s stock price declines.

Their business model revolves around identifying potential fraud cases, publishing damaging reports, and taking short positions to capitalize on falling share prices.

While short-seller reports can sometimes uncover legitimate concerns, this particular report on Gigacloud is riddled with half-truths, misrepresentations, and outright errors.

Here’s what they claimed:

The GigaB2B marketplace has almost no traffic – Grizzly claims that GigaCloud’s marketplace only receives 50 visitors per month, which, of course, would be insufficient to support its reported revenue.

GCT lacks the infrastructure and operational capacity to support its business – The report suggests that warehouse visits revealed little truck activity and that the company does not have enough employees to run its logistics network.

Financial manipulation through weak regulatory oversight – Since GCT’s auditor is KPMG China, Grizzly argues that the company must be inflating revenue and understating costs through its VIE structure, taking advantage of lax oversight.

Aggressive insider selling – The report highlights that company executives, including CEO Larry Wu, sold shares in May and June 2024, which Grizzly claims is a red flag.

You can find the whole report here.

While these claims may seem concerning at first glance, a deeper analysis quickly dismantles them.

Let’s debunk these short-seller claims

1. Web Traffic: The 50 Visitors Per Month Myth

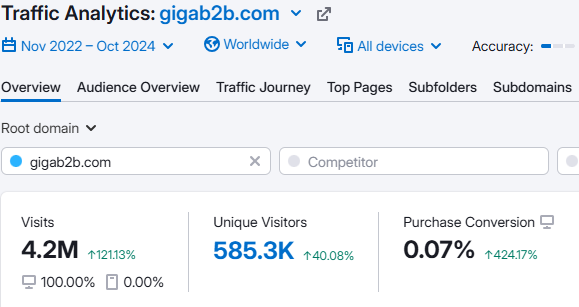

One of Grizzly’s main arguments is that GCT’s Gigab2b.com marketplace has no real activity, supposedly receiving only 50 visits per month. However, this claim is based on a misinterpretation of web analytics data.

Short sellers confused website searches with actual traffic, leading to completely inaccurate conclusions. In reality:

GigaB2B has seen over 4.2 million visits in the past two years, representing a 121% increase from prior periods.

585,000 unique visitors have accessed the platform, far from the "50 per month" Grizzly claims.

Grizzly’s entire fraud narrative hinges on a flawed data point. Once corrected, their argument collapses.

2. Infrastructure & Warehouse Activity: The Truck Misconception

Grizzly argues that GCT lacks the infrastructure to support its business, citing low truck activity during their warehouse visits. However, this is based on a flawed observation window—they simply visited at the wrong time.

What they missed:

GCT staggered its delivery schedules throughout the day to avoid congestion, which explains why certain locations appeared quiet at specific moments.

The claim that GCT employs very few workers per warehouse ignores the company’s cost-efficient strategy of using contractors, which keeps fixed costs low while maintaining flexibility.

Unlike traditional logistics firms, GCT operates with a lean model, outsourcing last-mile deliveries to partners like FedEx. This strategy allows the company to secure deep volume-based discounts, sometimes exceeding 90%, making their logistics operation even more cost-effective.

So apparently short sellers misunderstood GCT’s highly efficient, asset-light logistics model, leading them to a false assumption about infrastructure limitations.

3. Financial Manipulation Through Weak Regulatory Oversight? Nope.

Another key claim in Grizzly’s report is that GCT is exploiting regulatory loopholes due to its auditor being KPMG China. The implication? That this setup allows the company to inflate revenue and hide costs.

But once again, the facts tell a different story:

GCT voluntarily chose to adopt U.S. regulatory standards. Unlike past fraudulent Chinese companies, GCT has been fully compliant with U.S. Generally Accepted Accounting Principles (GAAP) since 2024. This means they follow the same financial reporting rules as any other publicly traded U.S. company.

Three out of four top executives, including the CEO, live in the U.S. Offshore companies trying to evade regulation usually keep leadership outside of U.S. jurisdiction—that’s not the case here. GCT’s leadership is physically present in California, making fraud far riskier.

The company is actively considering switching to a U.S.-based auditor. Conversations with management indicate that GCT may transition from KPMG China to a U.S. firm to further enhance transparency and credibility.

Unlike past fraudulent companies like Luckin Coffee, GCT has taken proactive steps to increase oversight and accountability.

The short-seller argument about "regulatory gaps" is outdated and misleading.

4. Insider Selling: Misrepresented and Overblown

Grizzly Research claims insider selling is a red flag, implying that executives are cashing out before the business collapses.

Yes, it’s true—CEO Larry Wu sold one million shares. But context is everything.

Wu’s sale represented just ~10% of his total holdings. If he truly believed the company was fraudulent, he would have sold significantly more. A partial sale like this is normal for executives managing concentrated wealth.

The sales were conducted through Morgan Stanley over two months, not dumped in one go. This structured approach suggests a planned diversification strategy, not panic selling.

The stock had rallied to a price that reflected fair value. It made perfect sense for Wu to trim a small portion of his holdings—just like any rational investor would.

Wu remains a major shareholder, and his actions align with rational financial planning rather than insider fraud.

So it‘s clear, the insider selling argument lacks substance.

For those who want to dig deeper, Seeking Alpha put together a solid breakdown debunking the short-seller allegations—worth a read.

Now we know why the stock is trading at such a discount.

Let’s get back to the valuation:

Again, GCT is currently trading at an EV/EBIT ratio of 7.3, while the industry average sits around 11x–12x.

It’s also trading at just 6.19 times earnings, compared to the industry average of 11.3x–16.3x, depending on whether you use forward or trailing numbers.

Just based on these numbers alone, a fair valuation lands somewhere around $45–$50 per share.

And that’s without even factoring in its massive 70% YoY revenue growth, 64% YoY increase in adjusted EBITDA, or its strong cash position with no long-term debt.

If you go by DCF models, fair value could be closer to $60 per share. But let’s be real—DCF models can be debated, so I wouldn’t rely on them too much.

And finally, let’s throw in some (magic) technical analysis:

GCT is currently squeezing, which could indicate a potential breakout. The $17 level has proven to be a strong support zone.

If you believe in the fundamentals, now wouldn’t be a bad time to buy.

If you’d rather play it safe, I’d wait for a bullish breakout with strong volume as confirmation for a potential run toward fair value.

At the end of the day, GCT is a textbook case of market inefficiency—a fundamentally strong business that’s temporarily mispriced due to misinformation.

For those willing to look past the short-term noise, this could be a rare opportunity to invest in a high-growth, profitable company before the market corrects its mistake.

Disclaimer: This is not investment advice. Nothing I write is investment advice. Some of the stuff I write will turn out to be incorrect. Do your own research before making any investment decisions.