Overlooked Net-Net at 0.36x Book and 3.6x Earnings

When a boring balance sheet becomes a beautiful opportunity

Key Metrics:

0.38x book value

3.6x earnings

20+ years dividend record

No long-term Debt

50% discount to NCAV

From 1952 to 1962, Warren Buffett compounded his net worth at 48% annually.

He bought tiny, illiquid businesses trading at absurd discounts.

Stocks so small that institutions ignored them.

Stocks where a little research could turn up life-changing results.

He started out with egregiously cheap names like Greif Brothers Cooperage and Western Insurance. Later, he moved on to small stakes in bigger companies. And eventually, he started buying entire businesses outright.

People will tell you the market is efficient.

They are wrong.

If you're working with a small capital base, a halfway rational brain, and an endless supply of curiosity, you’ll find inefficiencies.

And I think today’s stock is exactly that.

An inefficiency.

A stock trading at a valuation that simply doesn’t make sense.

Deswell Industries (NASDAQ: DSWL)

The company I am talking about is Deswell Industries (NASDAQ: DSWL) – a quiet operator, overlooked by Wall Street and under the radar of most investors.

Founded in 1987 and incorporated in the British Virgin Islands, Deswell Industries is an international and long-established manufacturer operating out of Dongguan, China.

The company specializes in two core segments:

Plastic Injection, Tooling & Molding and Electronic Product Development & Manufacturing.

Supplying components and finished products to original equipment manufacturers around the world.

Deswell's plastics division produces everything from cases for power tools and electronics to parts for medical devices, automotive components, and robotic equipment, using advanced techniques like film and insert injection.

The electronics side assembles studio-grade audio equipment, wireless receivers, complex circuit boards, and medical electronics.

What sets Deswell apart is its close integration into customer supply chains.

For more complex projects, they work side by side with clients—from early design, to mold production, all the way to full-scale manufacturing. This makes Deswell a deeply integrated partner rather than just another contract supplier.

Deswell serves customers across the U.S., Europe, Canada, the UK, and Asia.

So in short: this is a global operator, quietly doing essential pre-production work behind the scenes.

Let’s dig deeper and see why this might be exactly the kind of opportunity a young Buffett would’ve been interested in:

The Numbers

Let’s start by looking at where the money comes from.

Deswell operates through two core segments:

Electronics Segment:

Revenue: $56.98M

Share of Total Revenue: ~82%

Plastic Injection Molding Segment:

Revenue: $12.60M

Share of Total Revenue: ~18%

(as of 31.03.2024)

The electronics segment is by far the company’s revenue driver, contributing roughly four-fifths of total sales.

Interestingly, even though it’s the smaller segment, the plastics division posted a higher gross margin in FY 2024 (23.3%) than electronics (19.3%).

Since the business relies heavily on a handful of B2B customers, revenue isn’t exactly predictable year to year.

But zoom out far enough, and you’ll see that revenue has grown at a solid pace over the past decade.

Yes—sales have dipped slightly since 2022, but recent quarters show signs of recovery.

As CEO Edward So explained:

“Revenue decreased during the period primarily due to the inflationary environment and less consumer spending on non-essential items such as home audio equipment and audio products. In spite of the slight sales decrease, measures taken to moderate raw material and labor costs enabled us to report solid gross margins consistent with the previous year.”

He also added:

“We reported healthy operating income of $1.8 million for the period with significantly higher net income of $6.2 million due to non-operating income from investments… Our strong balance sheet with its solid cash position and no debt enables us to implement our long-term growth strategy... while also returning capital to our shareholders with a consistent dividend.”

To me, this doesn’t look like the start of a long-term decline—just a reflection of the cyclical nature of the business.

The company also made this clear in their 20-F:

“Other than as disclosed elsewhere in this annual report, we are not aware of any trends... likely to have a material effect on our net revenues, income, profitability, liquidity or capital resources…”

So while revenue has fluctuated a bit, it’s not a red flag.

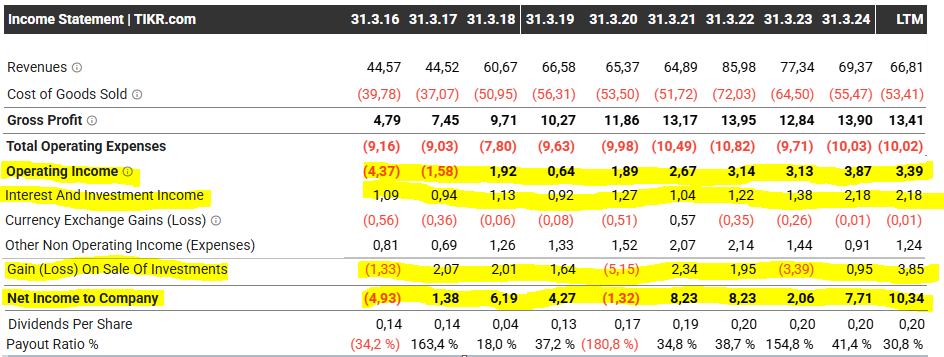

→ Income statement excerpts

Gross Profit, Operating Income & Net Income

Gross profit has remained relatively stable since 2021/2022.

Management attributes margin improvement to lower raw material and labor costs, better supply chain control, and a more favorable product mix.

But as they’ve stated themselves:

“Our gross margins fluctuate from year to year.”

And:

„We expect gross margins generally and for specific products to continue to fluctuate from year to year. Fluctuations in our margins have been affected, often adversely, and may continue to be affected, by numerous factors, including cost of raw materials, costs of labor, and exchange rates“

Operating income, on the other hand, shows a more promising trend—it’s been rising steadily year-over-year.

Net income, however, tells a slightly different story.

Because a big chunk of Deswell’s liquid assets is invested in short-term financial instruments (like bonds), their reported net income fluctuates more—reflecting gains or losses from these investments.

On average, net income has been trending upward. In fact, it's currently at an all-time high.

Dividend & Capital Allocation

One of the most attractive features for value investors: Deswell has paid a dividend consistently for over 20 years.

For the last four years, they’ve paid $0.20 per share annually, which translates into a dividend yield of 8.6% at current prices.

They paid out around $3.2 million in dividends in FY 2022, 2023, and 2024. Roughly 30–40% of their net income.

The rest has been reinvested, steadily increasing equity and shareholder value (more on that in a second).

Let’s be clear: this isn’t a growth story.

I’m not trying to present Deswell as the next blue-chip S&P 500 company.

This isn’t about aggressive revenue expansion or explosive earnings growth.

Instead, the income statement shows: Deswell is a consistently profitable, well-managed operator.

It generates solid returns, pays a healthy dividend, and reinvests intelligently.

And while that’s good to see, it’s not even the main reason we’re here.

The real opportunity lies in the balance sheet.

Let’s take a closer look.

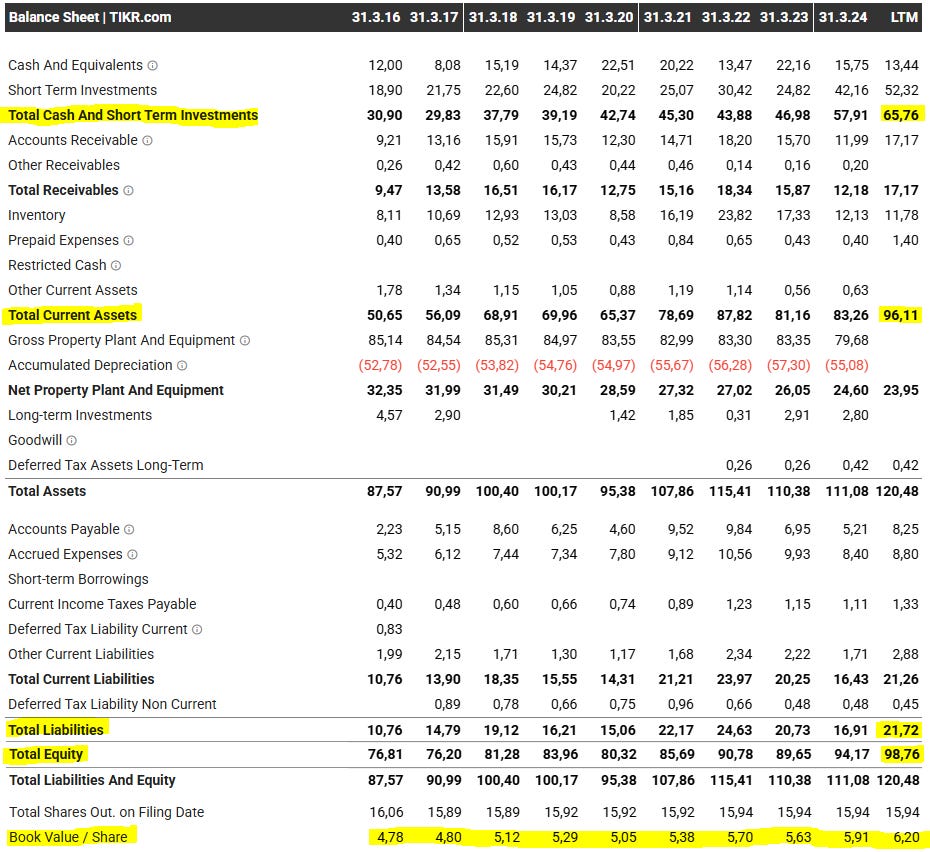

Balance Sheet

DSWL is sitting on a massive pile of liquid assets.

The company holds $13.44M in cash and another $52.32M in short-term investments, mostly bonds.

That’s $65.76M in liquid assets alone—nearly double the current market cap of $36.97M.

Inventory is just $11.78M, which is great to see from a valuation perspective.

Less inventory means lower risk of write-downs or hidden losses buried in unsold goods.

DSWL also carries no long-term debt and no goodwill—just hard, tangible assets.

That kind of balance sheet strength gives Deswell serious downside protection.

In fact, the yield from its investments alone is enough to cover the company’s dividend payout, regardless of minor swings in revenue or margins.

Thanks to consistent reinvestment of profits, book value per share has been growing year over year— a quiet compounding playing out in the background.

NCAV Breakdown

As mentioned before, Deswell is a classic Net-Net.

It trades far below its net current asset value (NCAV), which is often considered a rough estimate of liquidation value.

In other words, if the business shut down today, sold off its inventory, collected its cash, paid all bills—and handed what’s left to shareholders—you’d walk away with more than the current stock price.

Here’s the math:

Net current asset value (NCAV) = Total Current Assets – Total Liabilities.

Current Assets: $96.11M

Liabilities: $21.72M

NCAV = $96.11M – $21.72M = $74.85M

With a market cap of $36.97M, that’s a 50.6% discount to NCAV.

There are 15,935,239 shares outstanding, so:

NCAV per share = $74.85M / 15.94M = $4.70

Current share price: $2.32

You’re essentially buying the business for less than half of what it’s worth if it shut down and liquidated tomorrow.

Let that sink in.

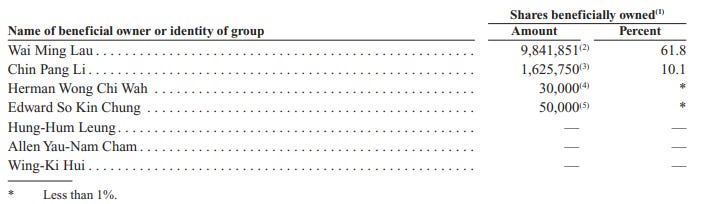

Ownership

Ownership is a particularly interesting aspect of Deswell.

The company is heavily insider-owned.

Usually that’s a good thing. It shows that management has real skin in the game, aligning their incentives with those of other shareholders.

But when a small group controls too much of the company, it can become a risk.

In some cases, it opens the door for management to run the company for their own benefit, with little regard for minority shareholders.

So I took a closer look.

As it turns out, just two members of management control over 70% of the outstanding shares. The largest stake belongs to Wai Ming Lau, who holds 61.8% and currently serves as Chair of the Board.

Here’s what the company itself states in its 20-F filing:

“As of June 30, 2024, Wai Ming Lau beneficially owned approximately 61.8% of our outstanding common shares, allowing Ms. Lau to control the outcome of all matters requiring approval by our shareholders, including the election of directors and approval of significant corporate transactions.”

I’ll be honest: when I first read that, it made me nervous.

So I kept digging, and what I found was actually quite interesting.

Wai Ming Lau hasn’t always been the majority shareholder.

In fact, she has been for just over a year!

Apparently, the previous majority owner, Richard Pui Hon Lau, passed away on June 12, 2023, and left his shares to Wai Ming Lau.

The company hasn’t disclosed their relationship, but the wording in the filings suggests they were closely connected.

“Mr. Lau passed away on June 12, 2023. Upon settlement of his estate, Ms. Lau inherited all of the Common Shares owned by Mr. Lau.”

At first glance, this level of concentrated ownership gave me pause.

And once I realized that the company’s majority shareholder and Chair of the Board had only stepped into that role about a year ago, my concerns grew.

I started to wonder: Who exactly is Wai Ming Lau? Is she really qualified to hold that much power—or is this a red flag?

So I dug deeper.

And I actually liked what I found.

She’s 45 years old, holds a bachelor’s degree in accounting from George Washington University (2001), and has been accredited by the AICPA since 2003.

So far so good.

But her resume goes further.

She previously served as Executive Director at PAG Consulting, where she led their global human capital division. Before that, she spent seven years at Deloitte in audit and tax, several of them as a manager.

And just before joining Deswell, she worked for 13 years at Goldman Sachs—most recently as Executive Director in their Finance Division!

After learning all this, I started to view her ownership not as a risk—but as a genuine asset.

Given her background, I wouldn’t be surprised if she had a hand in driving Deswell’s record net income last year.

One more important point: She’s the Chair of the Board—not the CEO.

The CEO, Edward So Kin Chung, has been with Deswell for 18 years. He knows the company inside and out.

I’d bet that this combination of institutional knowledge and financial expertise will work out well for shareholders.

Now let’s talk about a few things I don’t like.

Risks

The first one is customer concentration.

As of 2024, Deswell’s top four customers account for 45.4% of total revenue. Which creates quite the dependence.

The company is upfront about this, stating:

„We are, and have been, dependent on a few major customers, the loss of, or substantial reduction in orders from, which would substantially harm our business and operating results.“

That said, this isn’t a new risk for Deswell. They have been dependent and expect to continue to depend on a small number of customers for a significant percentage of its net sales.

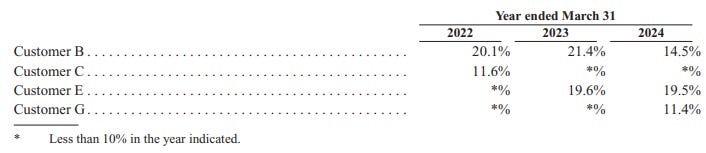

The following table outlines Deswell’s major customers that accounted for 10% or more of net sales during fiscal years 2022, 2023, and 2024:

Another detail that’s not exactly reassuring: Deswell doesn’t have long-term contracts in place. Most sales happen via short-term purchase orders.

„Our sales are based on purchase orders and we have no long-term contracts with any of our customers and the percentage of sales to any of our customers has fluctuated in the past and may fluctuate in the future“

China Exposure

Even though Deswell feels more like an international operator than your typical “China stock,” the company still runs most of its operations out of China.

So you might think Trump’s new sanctions would’ve affected the company, or at least its share price.

Well… not really.

The stock didn’t react at all.

In fact, it hasn’t done much of anything over the past year.

After digging a little deeper, I found out why.

There wasn’t much reason for the price to react.

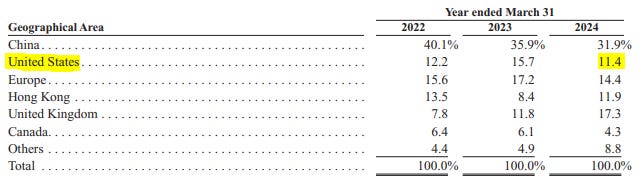

The U.S. isn’t a major market for Deswell. As of March 31, 2024, the U.S. made up just around 10% of total revenue, making it only the fifth-largest sales region.

That means sanctions or trade tensions don’t really carry much weight here.

And even in a worst-case scenario, if future restrictions did hit Deswell hard, the company has stated in its 20-F filing that it retains flexibility to relocate operations if political hurdles become too great.

Sure, that would come with short-term pain, but it wouldn’t be a death blow.

One more nuance worth pointing out:

Deswell’s reported sales by geography can be a bit misleading. Many of its “China” sales are actually to foreign customers with local delivery addresses.

“We believe that our reported sales by geographic area do not necessarily reflect the final destinations of our products or the actual nationalities of our customers. For example, we have reported product sales in China amounting to 31.9% of our total net sales for the year ended March 31, 2024 because China is where our customers directed us to deliver the products. However, we believe that these sales were to offshore customers using local China shipping destinations, which in turn, transshipped our products offshore.”

In other words, China may not be nearly as big of a final market for Deswell’s products as it looks at first glance.

Final Thoughts

This isn’t a growth rocket.

It’s not the next big thing.

It’s not even all that pretty.

But that’s the point.

This is a simple, stable, cash-rich business trading at a level that makes no real sense: a 50% discount to its liquidation value, with consistent earnings, no debt, and decades of operational history behind it.

Not because something is fundamentally broken.

But because no one’s looking.

It’s too small for Wall Street. Too boring for headlines. Too under-the-radar to move the needle for institutions.

But for individual investors willing to do the digging, that’s where the opportunity lies.

Buffett didn’t build his early track record by buying greatness—he bought mispriced simplicity.

And Deswell might just be one of those rare cases.

A quiet little business the market forgot.

But the numbers didn’t.

Disclaimer: This content is for informational and educational purposes only and should not be considered investment advice. I’m just sharing my thoughts—not telling you what to do with your money. Some of what I write may turn out to be wrong. Always do your own research.

Reminds me of Micheal burry write up

when you find a small illiquid chinese company what do you look at exactly to make sure that is not a scam?